Perhaps the most interesting part of the article:

Climate change makes risk unpredictable; risk makes insurance unaffordable or unavailable; no insurance makes mortgages unavailable; without mortgages property values crash

Why is it without mortgages property values crash? Is it because sellers are forced to sell to only people who can pay cash? I suppose that makes sense. And of course those won’t be “people”, those will be banks and investment companies, looking to rent the property out to tenants. So more large chunks of money are siphoned away from the middle class.

If a property is at risk and uninsurable, banks won’t provide good terms for a mortgage, because ultimately the property is at risk. This means they’re either going to lower the mortgage, or increase the rates. This means less money is available to purchase the property, which forces a lower price on the seller (because nobody else could buy, unless they use cash, but why would someone pay cash on an at-risk property?).

Man insurance is such a scam. They’ll only actually offer hypothetical coverage if they know you won’t need it 😅

Actually need it? “Well, we have to make a profit! Why would we pay for that thing you’re paying us to cover?”

Yeah it is. I made a claim for hail damage then It made me uninsurable/insane premiums when I moved for 5 year, no fault thing from mother nature but ya know it’s my fault they had to pay out. I was told if I made 3 or more claims in 5 years I be uninsurable, hoping my home stays safe from this fire that’s 2miles away from me…

The thing is if you buy a home and in California it’s likely 1mm plus in the la region. You’re paying huge mortgage rate more so with insurance and the recent rates basically house poor. If you loose your house you still have to pay the bank so you can’t afford to live anywhere right? So with out insurance buying a home is one step away from being destitute?

It’s needs to be a state sponsored thing and nonprofit. Like fire departments if everyone loses their home who’s left to taxes, or even stay there.

I live 1 mile from the no insurance zone and in Los Angeles it took me weeks to find anyone to even cover our home after being dropped because “we have a flat roof” we don’t, it’s bs excuse.

Seems to me non privilege stuff should be a government run thing. Everyone should have a right to health care and housing and food. None of this shit should be for profit, fuck insurance.

Sorry realized I went on a rant.

I’m in a safe-ish area and was told 2 claims in 3 years and they wouldn’t renew my insurance. Been here over 20 years and had one claim 10 years ago.

Had lightning hit and called the insurance directly, they opened a claim number but we ended up not using it. Meaning they paid $0 because it turned out to be a simple fix, it was just scary in the moment at 3am with water gushing out (not into the house). So we just paid the $300 to fix it and they closed the claim.

Two years after that we called when a tree hit the house, went a different route and called the independent agent first, not the insurance company directly and that’s when we learned if we started a claim for the tree damage, they probably wouldn’t renew. Ended up being almost $3000 out of pocket so we can keep the house insured and the mortgage company happy.

Yeah that’s the worst, even if you just call them to ask if something is covered they will still make a note and use it against you.

Man insurance is such a scam. They’ll only actually offer hypothetical coverage if they know you won’t need it 😅

Actually need it? “Well, we have to make a profit! Why would we pay for that thing you’re paying us to cover?”

An insurance company takes the data it has about whatever someone wants to insure, uses its actuarial system to find out what its risk value is, and then charges you slightly more than that value over time.

You will probably never need the service, but if you do, they’ll help you out. Because they’re charging more than the actual risk value, over time and over a large enough subset of clients, they’ll make some profit, even while paying to replace or fix people’s houses. Which is fine, they are providing a service and there’s absolutely nothing wrong with profiting from providing a service. You win, they win, everyone benefits.

In return, you get the peace of mind of knowing that if the worst happens, you’ll be at least somewhat better off and able to afford to rebuild.

If the risk of event X gets too high in an area, and the company isn’t allowed to say, “You’re covered for everything but X,” the company would either need to charge enough to cover essentially the value of the house on such a short timeframe as to be untenable, or stop providing coverage. They don’t have infinite money, so if they‘re forced to provide coverage at a lower rate than the risk level, and something like a massive hurricane or flood or fire happens, they go bankrupt. Now no one gets their house rebuilt.

Just because a company only operates where they make a profit doesn’t make them a scam. They aren’t a charity or a public service.

I can’t help but see it this way too. And healthcare before some of the ACA’s protections was similar. “Yes, give us those premiums, everything’s looking pretty safe, we’ve got you covered if something happens! Wink wink, nothing does really, so we’ve got you!”

And then the moment that changes, it’s “woah there, too risky for us, are you crazy? We’re gonna lose money! You’re on your own”. And all the 10s of thousands paid when times were good and there was very little likelihood you’d need help are just gone, and fuck you.

I understand insurance companies only make sense if the risk of paying out heavily is small enough. But still, you paid to be covered when the shit gets bad, they should have to taper down over time or return some premiums or something. Not just “welp thanks for all the money, it looks like we’re gonna have to start giving some out soon so we’re just gonna stop here while we’re ahead”. It’s just a legal scam.

Don’t forget it used to be “We’ve got you covered except for the thing you’re actually sick with.” from when they refused pre-existing conditions.

Wish I could forget my friend. My mother got clipped with that, she ain’t been with us for a while and I finished raising her daughter for her.

Fuck “health insurance” companies. Free Luigi Mangi-mothafuckin-one, too!

Funny how the rich argue with climate change when it benefits them. For decades they denied it fiercely and now it’s time to pay… even if we take all from them (which we should) it’s not enough repair the damages their behavior caused.

There are many blue voters who live in areas affected by the Palisades fire

If you have the type of money required to live there you no longer get to be a voter, you gotta be a doer

Blue voters that happily generate more carbon that most of us.

I think the curious aspect of this is that business is absolutely aware, and acknowledges existence of the climate change.

lol dude climate change has been in companies’ drawers since the 1970s, for example shell and such. they just acted as if they didn’t know to continue selling at record speeds.

They should be putting in effort to reduce climate change impacts. It’s in their financial interest, even if they have no capability to have a moral motivation

I’m pretty sure these gamblers will profit all the way down.

wow, its almost as if we should cut off the heads of insurance CEOs and nationalize them all into one low cost government plan thats paid for with pennies on the dollar in taxes.

lol, who am I kidding. Idiot Americans will always prefer paying 3000 dollars for bad coverage, rather than pay 100 in taxes for great coverage.

Or, you know, tackle climate change. But both are equally unlikely.

You’d think that insurance companies would be on the forefront of pushing climate change mitigation and prevention specifically because the impacts of worsening climate change will have a massive impact on their bottom line.

Maybe they can counter some of the petro company propaganda with their own marketing.

TBH, if insurance companies started pushing for climate change policies it would probably make those policies less popular. If there’s an industry less trusted than Big Oil, it’s Insurance.

I’m thinking a death match between big oil and big insurance.

They’re in the business of making money, not fixing problems. It’s easier to just pull out of an unprofitable area than fix the Republican party’s head-in-their-ass ideas about climate change.

Their time preferences have been shortened to “this quarter” just like the rest of the economy. We would need to buy insurance plans that last decades and not renegotiate every year.

So long as we live in an economy designed to maximize GDP, this can’t work.

Why would they do that rather than just not offering plans in areas where they project they will lose money?

They’ll run out of places to sell insurance pretty fast if climate change isn’t effectively countered.

And that’s when you’ll start seeing the property insurance industry suddenly really give a shit about climate change.

With climate change, there is no option for “low cost” plan, government or no.

You can’t constantly have massive losses like these fires in a single area all paying out claims and expect to pay them off with low premiums.

Yeah the point flew way over that guys head

Did you pull a muscle? You know, stretching that hard to intentionally misconstrue what I said.

Seems to me that’s exactly what you said.

no, i said having a universal insurance would lower premiums significantly since there would be no corporate greed driving prices up for personal gain and everyone paying into a single pot.

But please, keep stretching. You are apparently treating this topic like a yoga class and gotta stretch stretch stretch.

Greed is bad, but its large losses in certain areas due to climate change-induced disasters that is pushing up prices far more than greed. You are the one that is stretching credulity more than a contortionist getting ready for their act.

And are you saying we should not have risk-based premiums? Sounds like you want the rest of us to subsidize living in a disaster prone area. I will gladly choose insurers that chops to drop clients in disaster prone areas so I can afford my insurance.

Yeah, I really do wonder when the government and rest of the people start to seriously consider if it is worth it dropping $50 billion on places like SoCal and South Florida every few years or so. At some point you need to do the math and ask hard questions about whether it is worth it, and the answer damn well may be no.

I haven’t seen it in the comments yet but this is just the death spiral of climate change. Everything will just get worse from here on out as long as society operates the way it does. To everyone’s “surprise” I’m sure.

You had me at cutting off the heads of CEOs.

Guillotines go brrrrrrrrr

Woodchippers. Guillotines are too 18th century. Put em’ in head first.

In that case my vote would be feet first. But I think they’ve caused enough pain to deserve a little on their way out ¯\_(ツ)_/¯

BUT MUH TAXESS

That is what confuses me. Nationalized Healthcare, even an extensively covered one (with dental, optical, and prescription meds included) will be much cheaper overall than the private bullshit happening now.

I never understood how privatization advocates so routinely get away with bullshit. How can anyone not see how public program failures are almost always the result of deliberate sabotage.

deliberate sabotage bought and paid for by the private industry, to increase public pressure to move more healthcare to the private sector, so CEOs can make more billions.

and i have no idea. americans are fucking stupid. “Do you want to pay an extra 100 dollars in taxes for great health coverage and no declining what you need?” "NO! I WANT TO PAY 5000 FOR COVERAGE THAT DENIES EVERYTHING, BECAUSE A POOR CEO NEEDS A NEW GOLDEN TOILET ON HIS 8TH YACHT "

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

LifeShareholders uh find a way.This is a really dumb take. Pulling out of a market where it’s impossible to even break even is not greedy or corrupt.

Yoink goes the coverage that you paid into!

And the shareholders rejoice.

Your homelessness is a you problem. You should have paid for some coverage in the event of such an occurrence.

That’s not how it works at all. You’re thinking of health insurance. This thread is about insurers declining to renew contracts, not denying claims.

This thread is about insurers declining to renew contracts, not denying claims.

So hanging around to extract insurance premiums for as long as possible, then fucking off before they have to start making any of that money flow in the other direction?

FFS, no. Do you even know what insurance is? They are always on the hook to make payouts for any policies that are active, and it happens regularly. Most of the money they take in goes toward paying claims. Most of the rest of the money goes toward overhead, which includes paying actuaries to evaluate how much risk they’re taking on and how much future payouts are going to cost. They determined that providing homeowners’ insurance in CA would soon cost them more in payouts than the state allows them to charge in premiums, so they decided to stop doing business in CA. Nobody was scammed. Their customers all got what they paid for while they were paying for it.

This reads like apologia for the insurance industry. Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value. I can almost see the vein on your forehead throbbing as you try to explain what insurance is to me. I understand how insurance works, but am resisting the almost overwhelming urge to reply KenM style.

Yoinking an insurance policy for my Fabrige egg collection, because I won’t stop juggling them? Cool.

Yoinking coverage for my my home, which I’m basically anchored to (proximity to work, schools etc.), while you slink off with your profits? Not so cool.

What does “uninsurable home” do to property values? The insurance companies will do fine, while I’m left to sort this out (lose everything).

I understand why they pulled out. Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations? Do you understand how the non-insurability aggressively power-fucks those stranded home owners ability to salvage any equity in their homes?

The guillotines will be adorned with the Surprised Pikachu face.

Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value.

A lot of insurance companies, including big ones like State Farm and Liberty Mutual, are owned by their policy holders. So yeah, I made the mistake of not mentioning their fiduciary duty to maximize value for their customers.

Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations?

What do you expect insurance companies to do about it? Keep offering policies and collecting premiums while knowing they won’t be able to pay all the claims they get? That’s called fraud.

You say they’re “slinking off” as if they’ve stolen something, but what have they stolen? You say they’re leaving with their profits, but what profits are you referring to? Do you really think they’d be leaving if they were making money?

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

Look, I get that this is an easy go-to answer for many things, but please add this to expand your understanding a bit more so you have a more complete picture.

Not all insurance companies are public companies with shareholders to satisfy. Mutual Insurance companies are owned by their policy holders. Specifically with California, both State Farm and Liberty Mutual have both exited too. These are both large insurance companies that are NOT driven by “shareholder value”. Profits these companies make are issues as dividends to the policy holders, not shareholders.

So the issue of insuring property in California is more than just the standard “greedy shareholders” argument.

Risk makes insurance unaffordable or unavailable

Insurance should really always be available at some price if you don’t cap prices. It might be ludicrously expensive if insurers consider the area to be extremely risky – and this area has had serious wildfires in past months and years, and I’m sure is probably considered to be quite risky – but there’s going to be some price at which they should make a return, even if they think that there’s a pretty good probability that the house is going to burn in some kind of fire in the next N years.

If you don’t cap prices one something the insurer is expecting to be destroyed, wouldn’t they just set the price of the policy to be the price of the thing it insures, effectively making it worthless?

It most likely would just be a significant portion. Once a place is hit by fire, it takes a couple of years to be as susceptible again. Or, if it’s not been a recent hit, the odds of any individual place being hit in a given year is probably sub 25%.

So the insurance company would probably charge something like 20-25% of the value. Which, yes, is hugely unaffordable for 99.9% of people. But if you’re super rich is probably still worth it, as the reason the price is that high is that there’s a pretty good chance your house burns down in the next year or two, so you would come out ahead in that scenario.

Then again, once you’re rich enough to afford that level of insurance premium, you’re probably rich enough to just float the risk yourself. So yeah, probably pretty worthless across the board, even at levels fairly significantly lower than 100% of the replacement cost.

It’ll go up, sure. There’s nothing magical about the price of the property, though, as a line for making insurance worthwhile. You pay an annual rate, and an insurer will just expect that whatever you’re paying over the will pay for the cost of the property within the period of time until they expect the property to burn on average.

If it’s a hundred years, it might be – discounting, for simplicity, the time value of money – 1% of the property value annually. If it’s six months, it might be 200% the value of the property annually. The 100% mark isn’t a special line in terms of insurance making sense.

It’d certainly make the property more expensive to own as that percentage goes up, but that’s true whether you insure it and spread that risk over many houses or don’t insure it and pay for the loss of the thing yourself.

Isn’t it though? If my choice is to pay 200% of the value of the property annually or to not have insurance, why would I opt to have insurance? The best they could do is pay out less than I paid them.

Say I plan to sell the house in three months and want a three month term, maybe.

What you propose is illegal in California. It seems like a mildly counterproductive law, but I can’t imagine it would make much difference if they were allowed to offer policies nobody can afford anyway.

i kinda disagree. no business or government should be required to provide insurance just because you built a structure.

some things can just be not insurable.

If there was no cap on insurance, the market would absolutely fix the “uninsurable” problem. It might cost $90k a month to insure your home, but since they fully expect it to burn down in a few months, they’re likely to take a loss on that insurance.

Yeah. Insurance is for unexpected disasters. Building a house in a wildfire zone, tornado alley, or flood plain, those disasters are expected.

The challengee is (at least) two-fold: (1) existing homes that were once not in wildfire zones are now in them due to climate change, (2) some of the reason building is allowed into fire zones is to alleviate housing availability.

Tell that to the banks that won’t give you a mortgage loan without insurance.

Tell them what? Banks should not be offering mortgages on homes that are at to much risk to be insured. People simply should not be living in areas where wildfires are a near certainty.

I’m not saying that offering insurance to a given property owner should be mandated, but that there’s always some price at which providing insurance is worthwhile to an insurer.

Like, say State Farm’s model predicts – as it probably correctly did here – that a house is most likely going to burn in the near future. Say the next two years, on average. Your annual fire insurance might be half the rebuild cost of your house, but they can still offer it, even at those levels of risk.

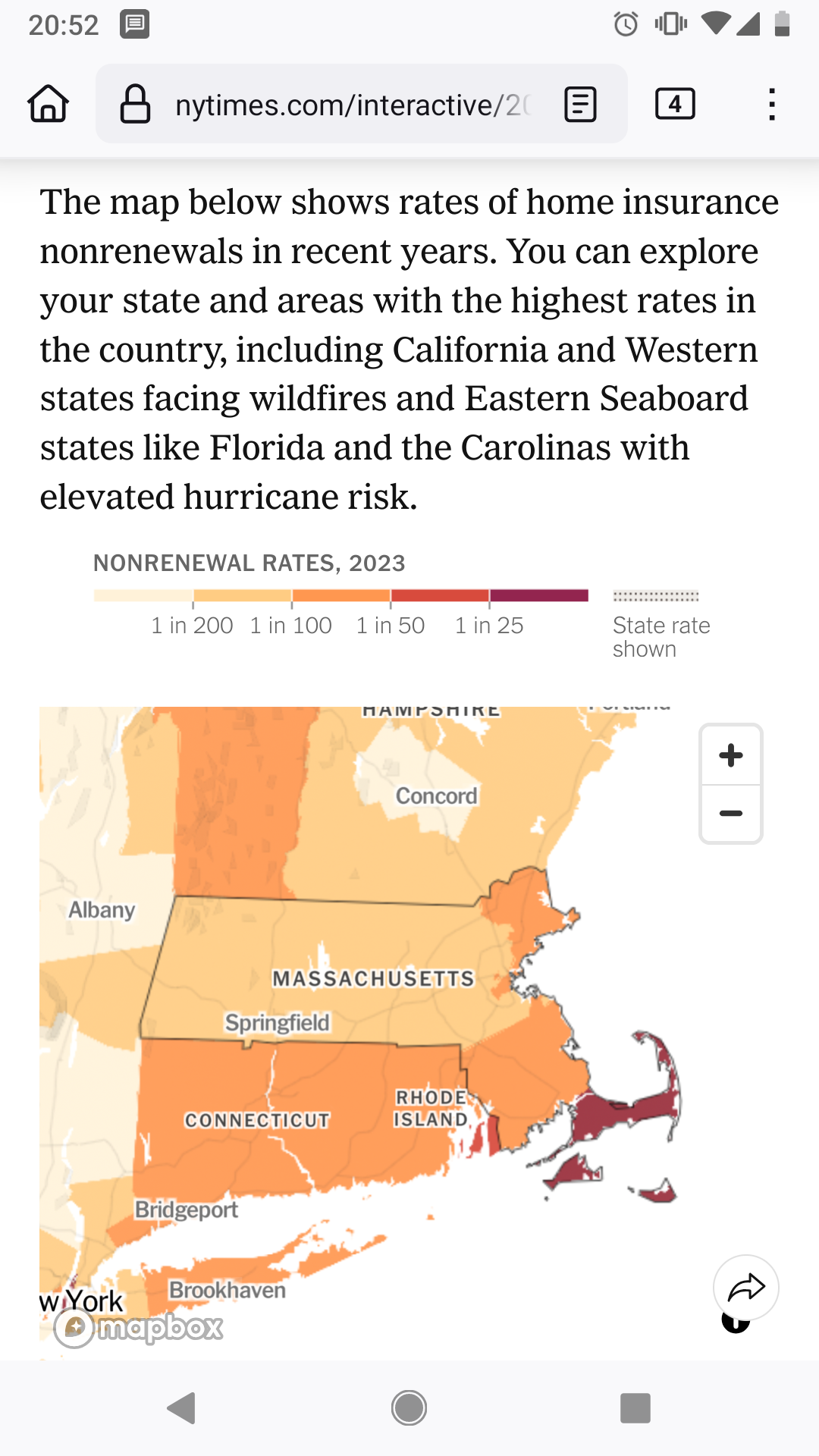

The map below shows rates of home insurance nonrenewals in recent years. You can explore your state and areas with the highest rates in the country, including California and Western states facing wildfires and Eastern Seaboard states like Florida and the Carolinas with elevated hurricane risk.

Louisiana be like, let’s add a few more refineries, and a ethane cracker plant for good measure

Someone should adjust the silhouette to look like Mario bros Luigi

The exposure isn’t quite right and there are artifacts, but I am not a graphic designer so 🤷

The exposure isn’t quite right and there are artifacts, but I am not a graphic designer so 🤷It’s beautiful lol, your skills are apt. I meant the Batman on the building silhouette but this is equally cool

I meant the Batman on the building silhouette

Aww dammit 😅

Speaking of the Palisades fire, I’m not sure if anyone has looked into this yet, but they probably should:

It’s true. I read it on the internet.

Everyone is saying it.

Fact-check that, Sugar-Mountain!

Wow, really compelling stuff. Zuckerberg really is a monster

Oh please please, keep em coming

Man, this thread is reminding me that Lemmy is even worse than Reddit when it comes to being populated by people who have strong opinions about things they don’t understand at all.

How so?

So many people here are speaking as if real estate insurance companies are doing something evil by pulling out of markets where it’s impossible for them to make a profit or even break even. The companies are not reneging on any obligations, just turning away customers they can’t afford to insure, and people here are responding by saying things like all insurance is a scam, and the insurance companies abusing their customers to enrich their shareholders.

I get the feeling they’re taking their opinions of the private health insurance market and applying them to insurance in general, and in doing so they’re demonstrating a lack of understanding of what insurance is for, why it’s required for certain purchases, and why people choose to do business with insurance companies even when they don’t have to

Yeah, this is why we shouldn’t allow for-profit insurance companies in the market.

I FUCKING LOVE MAGNETS

The insurance companies gotta keep their shareholders happy. That is the number 1 priority and fuck the customer.

I completely get the eat the rich mentality. At the same time, it really doesn’t make sense to rebuild some of these places. We’re all paying for it one way or another.

/a rub living in a flyover state that’s very boring from a climate change perspective, at least so far.

Absolutely, every single homeowner will pay for the insurance company losses. There are plenty of places that should have been left to nature. The entire Florida Oblast should be a National Park.

Insurance companies are scummy but the headline phrasing makes it seem like they JUST canceled the policies…but no, it was 6 months ago.

As much as I want to hate them for it, can you really blame them? Insurance operates under the measured assumption that most people won’t have to use it for some major. When wildfires become probable, it’s almost guaranteed to cost them exponentially more than homeowners paid in premiums.

Even if insurance cost $50,000/year, it would take several years of payments to cover the payout. And California has wildfires yearly.

For some reason you made me think of banks being covered by government insurance. In a way you’d think the government would also insure land, seeing as that’s one of the main things they protect.

The logistics would probably be horrible for that type of thing though.

Government can print money when appropriate and not abused. Payments directly to the general public are the best type of stimulus. Take a bad situation and make it a stimulus.

Part two though has to be that they are not allowed to receive a payout more than once or make it illegal to build new construction in wildfire zones until they have figured out the forest management issues.

There aren’t really forestry issues at all.

Practically everywhere is a wildfire zone though. Yes we need much more forest management, infrastructure hardening, fire resources, etc, but giving folks a one time payout and then they move to another area that gets destroyed and now they don’t get support doesn’t seem helpful since we can’t really predict what will burn. It’s simply harder than e.g. flood mapping.

You don’t have to drop the entire area though, you just have to drop forest fires as a claimable item.

Then people can make a decision on if that’s okay for them, or try to find someone else.

I know some areas have laws mandating certain minimal coverages. I wonder if the insurers would even be allowed to issue policies that didn’t cover wildfires.

If that’s the case, we might see some laws changing in the near future.

Would this not most likely still cause the same kind of financial collapse in the housing market that was mentioned as a possibility in the article linked by OP? If it is not possible to get insurance for an event (i.e. wildfire) that is likely(/definitely going) to occur, then I imagine buyers/real-estate developers would be less inclined to pay high prices in those regions.

You just can’t live any place and in such a fashion as shall certainly result in a loss

Especially for the palisades $3,500,000 homes.

At $50,000 a year it would take 70 years of payments.

Well, it should be proportional to the value they’re covering * the risk of loss, so they’re probably paying much more than $50000/year.

This is why insurance shouldn’t be for profit.

I think you might have missed the point.

I mean it would be great to have some kind of socialised home insurance that wasn’t “for profit”, but such a scheme should still refuse to insure homes which are likely to burn down.

That probably sounds good in your head. But you are only thinking of fires. What if they just pick the highest risk factor for every house and refuse to cover that. Then what would be the point of the insurance. And if you consider all the houses that are a high risk for something… fire, hurricane, flooding, high winds, tornadoes, earthquakes… you aren’t left with many houses.

What a silly thing to say.

Obviously, if one insurer refused to cover what ever thing, they would lose all their customers to other insurers who covered sensible risks.

The point is, you can’t insure against risks that are too likely to occur.

Let me rephrase. If they refused to insure any house that was a high risk for one factor. That would be a very sizable chunk of the country. Even if they only refused to insure it for the thing it was high risk for, it would make unsurance on the house pointless. Flood zones and wildfire zones particularly are expending every year. Hurricane zones used to be ok to insure because hurricanes didn’t hit too hard too often. But they are stronger and more frequent, so much of Florida has a very short list of insurers which will trend to zero in the near future. While I agree everyone should move out of florida because of the shitty politics, that isn’t really practical.

The cost of insurance needs to equal the risk though.

If a house is going to get burned down every year, who pays to re-build it?

It isn’t practical to expect everyone to move out of florida, but climate change is impractical.

Thats why i pointed at building codes. Require building that will survive the threat. Then people will have to pay more for them which discourages people from building in those areas at least.

Insurances need to cover their expected cost with the rates, otherwise they won’t be able to cover in case of an incident. Nobody will run an insurance expecting a loss, and you can’t force anyone to.

The alternative is like when we had flood that the state bails out the boomers who bought houses when they were cheap in areas where insurance won’t insure because of risk, paid with taxes by people like me who have a hard time acquiring property because taxes and other cost are so high due to decisions their generation and earlier ones made.

Of course, this is somewhat exaggerated; they also pay taxes. But it’s also not completely wrong.

In the particular case of a previous colleague’s house getting flooded, I always had to think of the fact that she chose to fly a certain route for work to save about 2 hours because it’s just so much more convenient than the train.

I mean it would have happened with it without her flying, but still thought about it.

They could cover a lot more if they didn’t need to make billions in profit. But your general concern is valid. What stops people from building in extremely high risk places. The answer should be federal building standards. If a house is built in a high risk area, it must have mitigating features that protect it from the high risk, or it can’t be built. Local building codes already do this sort of thing. So this is just an extension of something already done. Most people don’t know which areas are high risk for what. So don’t penalize them for getting duped. And in many cases the house wasn’t in a high risk area when built. So there needs to be funding to upgrade those houses to reduce the risk. That should come from the industries that profitted on ignoring the effects of thier industry in exchange for great profits.

I’m sorry, are we just skipping over the regulations that caused these companies to pull out? Most of these homes would still be covered. They’d be paying a higher price, but they’d be covered.

When you put a legal cap on costs, the company will pull out.

Yea that’s just basic economics.

Maybe we should have rules in place that provide more protection for actual human beings instead of prioritizing profit margins or pretending that “Basic Economics” is a universal law rather than a guideline of how people interact with each other. Sorry, I’m not mad at you, just the system we live in

We, did, they were pushed to the side. Those rules and protections were building more reservoirs, keeping those and the current ones full of water, continuous upkeep on fire hydrants, rehiring firefighters who were fired for not taking the vax, regular controlled burns, clearing out the undergrowth, not dumping water into the ocean after rainfall… So, so many that were completely abandoned.

You seem to think the prices for fire protection came out of nowhere, but they don’t. As these precautions were abandoned one by one, fire insurance went up, because the likelihood of a fire grew exponentially. When government put a cap on price, that effectively made it clear that the company would go bankrupt, completely, because they knew a fire was going to happen eventually.

We should be mad that those very protections put in place to help people were taken away by the government, not the companies.

Por que no los dos? The government is NOT faultless in this, but how often are those regulations removed because a company lobbyist

bribed themhinted very strongly that they would like that?

Turns out when you say you cannot charge more than x for a service that costs y to provide, and y>x, no one can sell the service.

Insurance companies fucking suck, but too many think their profits are the ONLY reason there is a problem.