The first time I applied for a loan, I didn’t have a credit card yet. And they were like:

How can we know you’re responsible with money?

Because I haven’t needed credit in the past and I’m still alive, idk? Having enough liquidity to not need credit would seem to suggest I’m good with money.

But maybe your parents are paying for everything

Ok? How does using a credit card change that?

They are NOT looking to see if you are responsible with money. They are looking to see if they can make money off of you, so they want you to be a heavy credit user. Before I bought my house I made sure to take out two credit cards and just buy random shit on them for a few months because that boosts my credit score drastically which then made it easy to get the loan. Banks HATE people with limited debt because it means you are not a loyal customer that they could make money off of. Yes, it makes no sense but that’s just how the economy works. Even if you don’t have any reason to buy things on credit, you still should. Even if you are very financially responsible, you should always have “stupid debt,” by that I mean debt for the sake of debt, because banks love that shit and it’ll help you out if you ever actually do need a loan for something.

Because people that quickly pay off their principal and avoid accruing interest don’t make the Credit Card companies as much money. They prefer people that are bad with money, sort of like how police departments don’t accept applicants that do too well on the tests.

That’s the impression I get too

But it’s plausibly deniable enough because you can still get decent credit score if you pay off your credit before you pay interest. It’s a numbers game for them, I expect, but still.

Considering how much data they can get on anyone, this process seems pointless and outdated, except to give them somewhat arbitrary power over who can get a loan.

Not that I like such private data to be available at any institutions fingertips, but so it is these days.

Bad take. In my situation it went from us paying $1900 in rent to paying $4500 in mortgage.

Well you made a choice. Either you knew you could make the payments for the price range you bought into, or you didn’t read the repayments figures on any of the documents the bank sent you and made a massive decision uninformed.

I pay 20% more for my mortgage than I did on my rent, but the house is also better, I can easily afford it, and I made that choice willingly and I’m happy with that arrangement.

The bad take I was referring to was OP claiming the mortgage payment would be lower than the rent payment. In the US this is almost never the case. Edit: we have fixed rate mortgages in the US. My payment will only go up because of taxes or insurance.

Most countries have fixed-rate mortgages. Most rental properties are also mortgaged. So a renter is paying for maintenance/insurance/tax costs, the landlord’s profits margin and the landlord’s mortgage.

This isn’t usually the case in the UK. Rent is generally much, much higher than mortgage payments.

All rents cover mortgage, taxes, insurance, upkeep, and usually a percentage profit on top of it all. Unless your lord is renting to you at cost or below (in which case they’re losing money (not counting equity)), then there is no way the cost to rent would be higher on an equivalent property.

Like just imagine if you wanted to rent out your property for $1900/mo - you couldn’t do it.

My old house went up over 400k between 2019-2025. So, if I’d sold it in 2019, they could absolutely afford to rent to me at a lower price than if I tried buying it again.

Yeah that’s the vagaries of the housing market and valuation, which is why I said equivalent property.

There’s also no reason you couldn’t sell that house for 400k less. The value is just the value. It’s going to be the same whether you’re renting or paying the bank for the same property.

I also won big by buying prepan, but who’s up or down in the Canadian housing lotto doesn’t change the physics of paying a lord’s mortgage costing more than if you were paying the bank’s mortgage directly.

Nevermind that whoever gets to be lord keeps the equity.

I think the point is that properties on market are, as a rule, not very recently purchased with a 30-year mortgage. So the monthly cost now required to cover the owners costs may be based on financial conditions from 6 years ago. If the rental market has a lot of properties that have been held a while but house values have rocketed, then you have a critical mass of owners willing and ready to out-compete brand new mortgage rates even if they ignore their equity advantage.

In my area, that’s what we see, real estate prices are dramatically up as are interest rates, so mortgage cost to acquire is a fair amount above the going rate to rent comparable properties. Someone getting a 30 year mortgage to rent out a property would be underwater for very many years in the current market conditions around my area, as they have to compete with more aggressive owners that have had their properties for many years.

Ah yes, I could see that situation arising, although frankly I’m as surprised to hear of landlords competing for tenants as I would be to hear of them selling their properties for under market value. Not that I’m doubting your honesty–it’s just not been my personal experience.

I’ve heard too many personal anecdotes of landlords trying to hike up rates by seeking spurious evictions, or refusing to install climate control, for tenants who are getting a “good deal” at lower rates. Maybe there are rational markets out there, but I don’t personally hold out much hope for landlords to be reasonable in the face of the dual pressures of fear and greed.

It depends on the market. Around here is similar, the market rental rate for a house is lower than what even the most lowest realistic monthly mortgage payment would be, but only by about 10% or so. I don’t know if you also dramatically upgraded your home quality.

Not too long ago around here it was the same as the post, renting higher than mortgage.

Even then over long term, the mortgage would make sense, since you can sell and get back some of the money and your principal and interest won’t magically get bigger because of market conditions.

In a sane world renting should be a touch cheaper than mortgage over the first few years, with tenants that only plan to be there 2 or three years. The owner gets a little income while taxes and insurance get paid and their asset maintained, and the tenant gets an easier and cheaper house to move in and out of for a short term living arrangement. Problem being when the market is upside down and when tenants are stuck never being able to build equity.

How??!

While renting in some markets can be cheaper than typical mortgage for comparable homes, the amount indicated seems a bit insane.

So either he is in a crazy real estate market, or there’s some additional context that makes it a poor comparison (going from renting in Virgina to Mortgage in San Francisco, going from a 1500 qt ft townhouse to a 3000 sq ft detached house with a quarter acre of land, or going for a 10-year mortgage). Or he’s just making it up or exaggerating because it’s the internet.

Interestingly enough that $4500 is pretty much exactly what it would be with 20% down on a $500,000 house for a 10-year mortgage. Of course, I’d expect such a house to rent for about $2700 rather than $1900. I could easily imagine he was renting a 2000 square foot 3 bedroom for $1900 and moving to what seems ‘slightly better’ 3000 square foot 3 bedroom with an extra special room or something, seeing that the 10-year mortgage is much cheaper in the long haul and going for it despite the huge monthly payment in the short term.

Even just renting an apartment is full of bullshit.

“The apartment is $1300 a month.”

“Perfect, I make $2000 a month.”

“No. You’re gonna need to make $3900 a month before we will rent to you.”

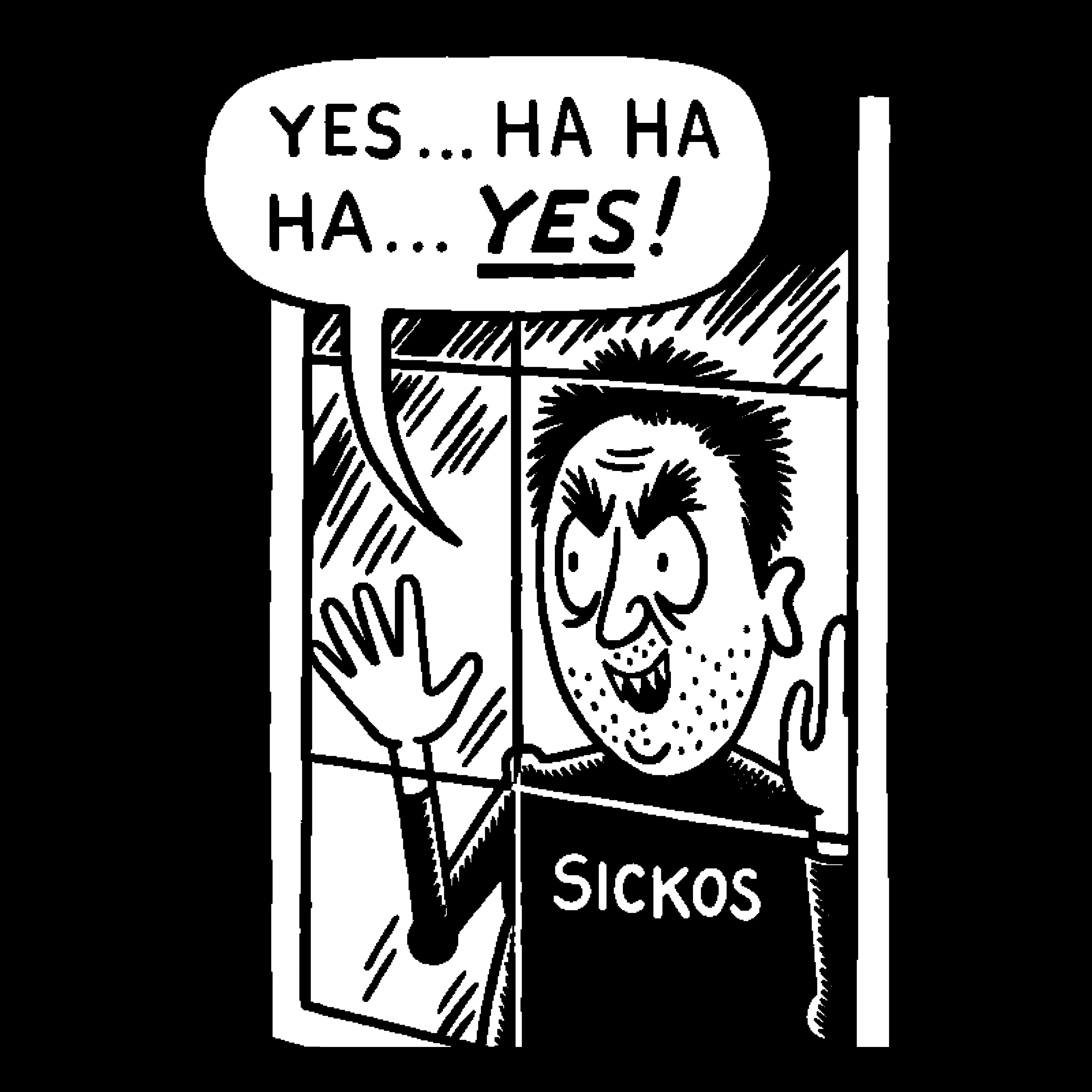

I live in the Toronto area and rent here is up to like $2600 for a 2 bedroom. Why haven’t we burned shit down? Why do we take this??

Im no leader but I’ll gladly build some gallows and die for my kid’s generation. Im also a vegetarian, but I’m willing to roast and take a bite of the billionaire just to show my conviction. I think we should actually literally do it with one to prove a point

Yeah, the 3x salary requirements are insane when housing accounts for almost 50% of people’s take home pay in most places.

3x rent is pre tax, 50% is after tax.

Just a small clarification.

There’s a rule of thumb that your rent / mortgage payments should only be 1/3 of your pre-tax pay. In expensive cities that’s sometimes impossible to manage. But $1300 out of $2000 means you’re spending 2/3 of your pre-tax pay on housing. If you’re taxed at only 20% that means your take-home pay is going to be $1600. After rent you’d only have $300 a month for food, utilities, clothing, transportation, etc.

If I were a landlord and someone on $2000/month wanted a $1300/month apartment, I’d be asking questions too.

you’re not gonna be able to afford this apartment after a few years of 10% rent increases, and we don’t want the inconvenience of evicting you when that time comes

Hmm. What if we abolish private property?

The deposit is not to prove you can make the repayments.

Housing markets do, occasionally, go backwards in value.

If you have a loan for a house which is more than the value of the house you would have an incentive to just stop paying.

Thats why the bank needs a buffer, in the form of a deposit. Its not really nefarious.

If the loan is fixed at an amount or matched to inflation, you’d still have to pay or lose the house.

That’s still a pretty bullshit excuse, because it’s not like all that money you’ve already spent on paying the house will magically come back to you, you’d still be homeless if you lose the house, and the bank would still have a house available for the market, even if it’s at a lower value than before.

I’m not sure if you’ve really understood the dynamic.

Suppose you buy for $700k, pay off $50k, but then the market collapses and the property is only worth $600k.

You’ll be $50k better off if you just stop paying and let the bank foreclose.

You’ll be $50k better off if you just stop paying and let the bank foreclose.

And do what? Live under a bridge? You would still have to buy a new house. Are you going to find similar house at $600k easily? Are interest rates still low despite market collapse? Will banks lend you money if just foreclosed?

Don’t be daft.

I’m not providing advice regarding what someone ought to do when they find themselves in negative equity.

I’m explaining the requirement for buyers to start with a reasonable amount of equity.

Once an owner falls into negative equity, they have an incentive to default on the loan. Yes there will be consequences, but the fact remains they will he weighing those consequences against the financial incentive to default.

The “better off” in my comment is an impartial objective calculation.

But what you’re saying is simply not true. Where I live you have to provide 20% of equity to get a mortgage but you can’t default when the prices go down. No bank offers mortgage covered in 100% by the house. If you owe the bank $600k you owe then $600k, that’s it. If you default and you’re house now only costs $500k you still owe them $100k.

So the 20% requirement has nothing to do with negative equity protections. It’s to limit the banks exposure in case you’re unable to pay.

Sorry chief, you’re just not picking up what I’m laying down.

Of course you still owe the money, you’re just much less likely to pay.

I don’t know how this works in US but where I live when you owe bank money they will simply garnish your wages and benefits. No one is defaulting on their mortgage to save money. That’s just not a thing. I personally know people who were paying their mortgages for many many years even though their house was worth way less then the mortgage. You just suck it up and hope the price will eventually go up. If it doesn’t it’s still better then living on the street.

I seem to completely misunderstand the dynamic.

As I see it, you have paid $700k for the house with the bank’s money (in this thread there is no deposit), bought back some of the house from the bank with $50k of your own money and then lost the house so you’re out $50k with no house.

If the bank does pay out some of the value of the house to you based on equity, it’s just going to be a smaller amount than $50k since the value of the house is lower and part of your repayment went to interest so you don’t even get $50k worth of equity. This feels like a worse position to me.

Like the bank has lost money for sure, but we are not getting that are we?

You’re overthinking it.

The loan history is not relevant. The $50k you paid is gone. Sunk costs fallacy and all that.

A mortgage isn’t a complicated shared equity situation.

You owe the bank $650k and if you don’t pay they will take the house worth $600k.

Obviously if you default there will be legal problems and you’re still on the hook for the last $50k and so on, but there’s no incentive to keep paying. Like if you declare bankruptcy then you don’t have to pay the $50k and you can start saving for a deposit on your next house for when the exclusion period expires.

Declaring bankruptcy would only be beneficial if the housing market fully crashed and it went down in price significantly and you don’t think it’ll be going back up within the next few years.

Not to mention it’ll be a lot harder to get a house in the future if you did that, and you’d get all the other downsides of bankruptcy as well.

Not to mention, this is all under a stay that assumes you’d actually be able to buy a house without a significant deposit.

Under the current system, it’d be an even bigger setback because if the house did lose a lot of value, now you’re also out a huge amount of money, still have to pay the full loan anyway, and it might take years to save up enough again to get a future house.

Basically, the banks are operating more as insurance gamblers now than they are lenders, because no matter what they win big. Even though banks should primarily work as centralized financial institutions rather than businesses, because otherwise they cause huge ramifications for the economy.

And if it gets so bad that the bank starts losing money… no worries, the government will simply bail them out like usual!

The alternative is some variety of private mortgage insurance. The insurer bets that housing prices will rise, so that you won’t default. If you do default, they reimburse the lender on their losses associated with your default.

It’s a little nefarious

nefari-ish, if you will.

you need to pay us interest because we’re taking the risk. Also you need to give us a down payment to offset our risk.

Correct.

Less down payment means more risk and therefore more interest.

Its pretty simple really.

But if you don’t pay, they get the house. There is no risk of loss, only risk of not maximizing profit.

Foreclosing is a very expensive process.

If you borrow 100% of the purchase price and the bank has to foreclose they would incur a loss.

Come back with some inheritance and then we will talk.

Not buy a house, inherit a house from our boomer parents.

They’ll sell it to pay for the elderly homes.

You’ll only inherit the clay ashtray that you made for them in 3rd grade.

Who didnt reverse mortgage it to pay for extravagant vacations.

Boomer parents: emotionally abuses you for your entire childhood/teenhood

Me: Has severe depression

Boomer parents: “WHY ARE YOU SO LAZY AND UNGRATEFUL, USELESS EATER, BURDEN ON SOCIETY” then proceeds to threaten to leave me out of the will.

Funny thing is, she also threatens to leave my older brother out of the will. Basically she tries to make us hate each other, and we do hate each other. My entire family is dysfunctional. They are all conservatives, racists, LGBT+ phobic, has the toxic masculinity mentality, ableist af. They think anyone with a slight disability deserves to get executed because its “a waste of resources”. This is why I dislike my ancestral homeland, it reminds me of hatred and intolerance.

Edit: Technically they aren’t boomers, but I’ll still call them boomers because they share that same boomer mindset.

Three kids, one house, we hunger gaming this shit?

'Cos two of us are married, there’s kids and that house only has three bedrooms and no land for extensions

(I kid of course, mu sister is inheriting my house when I inevitably explode)

People don’t want to twerk anymore!

At this point, yeah I would twerk on OnlyFans just to get a mortgage…

We have back problems now, Lauren.

Suppose I was the bank…

Guy1) Hey bank I want to sell my house for $1,000,000.00. Here is the deed, I owe $999,999.00 bank2.Bank1) OK I’ll take the house, here is $1.00 and $999,999.00 for bank2. Did you fuck up the house or burn it down to the point I can’t sell it?

Guy1) yup to the ground I burnt it all.

Assessor) I’ll charge Bank 1 $300 to go asses the price. Yeah currently this property can be sold for $300,546.00.

Bank 1) OK Guy1, you owe Bank2 $699,454.00 but here’s your $1.00.

Guy1) your honor I need to file for chapter 11. I have no money

Guy2) Bank 1, I would like to buy this property.

Bank1) Sure that’ll be $1,000,000.00.

Actually i guess the bigger issue is that we’re gonna be unemployed in 15 years due to a declining demand of human labor and then who pays back what?

Today you could afford the pay-back rate, but not in the future, and the banks are well aware of that.

Right? You don’t need to exist long term. Fuck off and die, meat.

There is no declining demand of human labour, and there is no indication that it will ever happen. The way the labour is performed is changing

Joke’s on them, I have a 15-year mortgage on my condo. (Lower interest rate than a 30-year mortgage, USA, ymmv)

“Landlords” are probably one of the oldest grifts in the book.

Mao did nothing wrong.

except for causing that famine.

if you can’t afford to own a home would you rather have no options to use one temporarily while you get back on your feet?

That’s not the point, and I can’t tell if you’re being genuine or arguing in bad faith. Do you want me to take the time and effort to explain why what you said is capitalist BS? I’m happy to if you’re genuinely interested in learning.

I’m aware it’s capitalist, however the alternatives tend to restrict what individuals can own significantly more than what I find acceptable

Should corporations be allowed to own private housing?

if residential properties are cheaper per square foot than storage units, then absolutely

Yep, that was a litmus test to determine if you’re worth my effort. You failed.

They don’t actually need regular payments for 10-30 years. They need you deposit that down payment cash ASAP so they can lease it to billionaires and crypto exchanges.

Idiocy.

The bank doesn’t get the down payment. The person selling the house does.

You pay that person the down payment, and the bank pays them the rest.

Honestly there’s loads of great reasons to hate banks but lots keep it real and avoid making up nonsense.

Banks typically ask for you to have cash in hand (deposited), or equivalent leverage, to qualify for loans in the first place.

The bank I used actively tried to get me to go with less down payment, and subsequently take out a larger loan.

But yes it is the height of idiocy to say, ‘down payment deposit’ when ‘qualifying assets’ is a more accurate term for the transactions function.

They need you deposit that down payment cash ASAP so they can lease it to billionaires and crypto exchanges.

No, this is patently false and borne of a misunderstanding. Idiocy.

When providing a mortgage, how does a bank get money to lease to billionaires and crypto exchanges?

Banks do leverage mortgage debt. Essentially the same process, in turn.

But how do they lease your deposit to billionaires and crypto exchanges?

The deposit is to cover expenses/losses that arise out of defaults. Housing loans have been lile this forever. Not everything is a conspiracy.

the deposit is the keep young, inexperienced and glowy-eyes people from making commitments they don’t have the stamina to handle.

it happens a lot that 20 year olds want to buy a house with their new partner that they think they’re gonna be together with for the rest of their lives, only to have it all fall apart 5 years later. forcing to you save up a bit before actually buying the house means you go through a lot of experiences before you actually buy a house, which makes it more likely that you’ll have the far-sightedness that’s needed to actually buy a house. :)

Not necessarily young but inexperienced yes

That’s one thing, but there’s definitely a factor of “if there’s a market downturn AND we have to foreclose, we don’t want to lose too much”.

The house you’re buying is the collateral for their loan. If you took out a loan for 100% of the value of the house and are immediately unable to make payments, the bank then owns the house. For them to simply break even, they’d have to sell the house for more than you paid for it to cover the various costs (lawyers, agents, etc.) If the reason you’re unable to make payments is that the economy crashed and housing prices tanked as a result, the bank couldn’t hope to break even on their loan.

The down payment is basically a way to ensure that in the bank’s worst case scenario they still don’t lose money. In theory, the bigger the down payment, the lower the risk for the bank, and the better a rate you should get on the loan. Multiple banks should all be trying to be the one to give you a mortgage, and should be trying to compete by shaving their margins as tight as possible given their risk tolerance. Of course, it doesn’t always work out that way, but there’s a reason for what they’re doing and it’s not just to screw over their customers.

They can’t really ensure a positive worst case scenario. 15% is the minimum down payment where I live unless you use extra collateral, but a home could lose half its value if there’s a major economic downturn.

They’re just mitigating bad scenarios, not anything close to the worst case.

The worst case scenario is that the Earth is hit by a giant asteroid. At that point what does a little risk hedging in a financial transaction matter?

I saved up a big (to me) chunk a few years ago, thought I was there. Expected the red carpet to roll out. Nooooope. There were people buying houses for $100k more than the asking price, sight unseen, within a week or two of the house being listed. My little $40k deposit was adorable, in comparison. I had no chance. Then Covid, life, etc…

The 100k+ over asking was the big deal because that never made it into the housing data properly so prices looked like they were lower than they were and we don’t have accurate comparison data now

Was it in a desirable location? Our tourist town went out of control with our of state buyers during the pandemic, but property values have adjusted back some and the market competition is gone. If you still have some of that $40k now might be a better time. My wife and I just did the federal First Time Homebuyers class and wound up getting a USDA rural development loan, they wouldn’t even let us put a down payment to lower our payments.

I am a skidmark that cannot believe that I live in a house that I “own”(have a mortgage). And I am so much less pessimistic about anybody’s potential to do what I did. I am happy to answer some questions. I make $22 an hour and my wife makes $17, the loan officer told me I almost make too much for the program.

How fucking old is this? Unless it’s a real shithole, mortgages have not been this cheap since Truss fucked up the economy

And while we’re ranting about this, can we throw PMI and whomever came up with it on the bonfire where they belong?

Your telling me that I need to pay for you to have insurance in case I default while your also charging me interest who’s very purpose is to offset risk? Why am I paying to offset your risk FUCKING TWICE AND HOW IS THIS FUCKING LEGAL.

Shit infuriates me. I want all the bankers to get William Wallace on live TV, recorded and played back once a year during a mandatory viewing window so that we never, ever, forget.

Also if you were to default they would take your house and get the insurance money

Its legal because value comes from ownership, not from doing things.

And if that sounds insane; you’re a fucking commie.

Is it ironic? We can’t know nowadays.

The vibe I get is that they mean it as a compliment

Im responding to someone saying laws not protecting the weak from the strong is a failure, so i think we’re pretty well i!to surrealist nonsense fantasy land.

Interest is not intended to offset risk?

Interest provides a return on capital.

If you have $1 youre not using you might let someone else use it if they incentivise you by giving you an interest in their need.

If you give $1 to 100 different people you might increase the rate for some of them to offset your additional risk, but thats not the purpose of Interest.

Part of interest calculation is risk. That’s why higher credit score leads to lower interest, it’s less of a risk to the lender.

PMI is double dipping. They can pick one, either a flat across the board interest rate for all borrowers or PMI.

Didn’t mean to imply it was entirely about risk.

The financial illiteracy of lemmy users always amazes me.

PMI is not double dipping.

It keeps the risk reasonable so that interest rates can remain reasonable.

With no PMI there’s extra risk that would need to be priced in to interest.

No one likes PMI, but it’s not evil.

Ok, your loan has been determined to be higher risk therefore you have to pay more. Why did we need to invent a second payment called PMI instead of just charging a higher rate to higher risk borrowers? Why do interest rates need to remain “reasonable” ?

That’s a good question actually.

In Australia, some 60 years ago, banks wouldn’t lend over 80% of the purchase price for a property.

The federal government created a government department to provide lenders mortgage insurance. It wasn’t a free government service, but a good example of the federal government stepping in to do something private enterprise wasn’t able to.

Since then of course that department has been privatised, like everything else, so private institutions provide that service now.

There do remain some differences between LMI and just simply extra interest. Notably LMI is a once off payment, and it can be included in the loan.

More recently, the Australian Federal Government has rolled out a scheme to pretty much abolish LMI. They’re just going to guarantee the loans for free.

Shit infuriates me. I want all the bankers to get William Wallace on live TV

Thanks for the hearty laugh

This is one of the reasons my wife and I took so long to get a house. I refused to pay this absolute SCAM. So we saved up to put 20% down. What a crock.

The alternative would probably be (much) higher interest rates until you get below 80% LTV at which point you’re “allowed” to refinance…but no bank will ever remind you of this in hopes you forget…or prime will skyrocket and you’ll be stuck in high interest for an unknown amount of time.

I think you should put away the monkey paw before they get more inspiration.