- cross-posted to:

- technology@beehaw.org

- cross-posted to:

- technology@beehaw.org

I know this is more business than tech related, but for some reason I am not able to post it to the business community, so I’m posting it here.

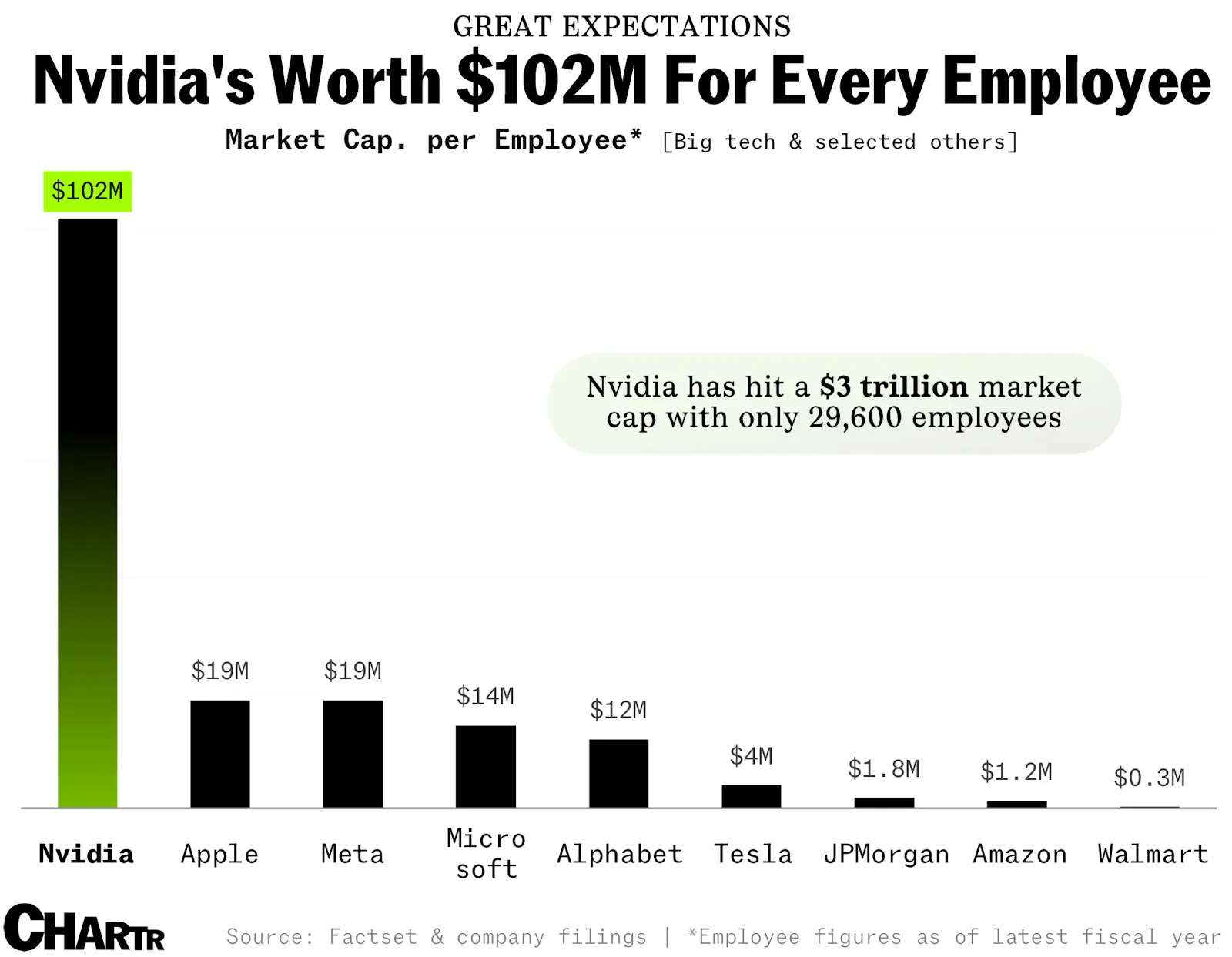

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

I’m like 90% sure Nvidia employees get stock options, but I’m not sure if that’d be the case for the newest batch of hires.

But yeah, this is a clear cut illustration of how salaries undervalue the actual labour provided, I don’t think any Nvidia employee’s getting 100M from their stocks + salary.

Ummm, nope. Some might, but not everyone by a longshot. Salaries aren’t great either.

Hmm, interesting, are you able to expand on that at all? The people I know who are retiring have been there a decade or so, I’m wondering what newer hires are experiencing.

I don’t know about Nvidia specifically, but I mostly only see RSUs offered to Staff/Principal level engineers or Director and above on the management track. Many times with a multi year vestment period to act as a retention tool. You can make out good at the exiting end of the deal.

IMHO its a shitty practice. There is risk if the C-level pulls some stupid shit tanking the stock. The reward could just as easily be distributed to employees with a profit sharing bonus that eliminates the risk of my options tanking while vesting. Let the employees convert to options if they want to stake on future company performance.

At least in the US, I could have used the value of my options earlier in life to help with student loans, buying a house, medical issues, having kids, etc. I grew up poor. I “pulled myself up from bootstraps” and am doing well now. I still think the whole system is a dumb gimmick.

RSUs are kinda shit too though. According to coworkers at my company that are actually valued enough to receive them, they’re pretty difficult to sell

RSUs cannot be sold, but they can be vested.

Very true. I personally know two people who were at Nvidia who have retired/are in the process of leaving now, and it hasn’t been a hassle for them personally. That obviously doesn’t speak for everyone ofc.

I also think Nvidia wants to buy back as many shares as possible from their employees like every other big public tech giant is doing right now.

From this, it describes someone losing half a billion dollars which would leave them with over 300 million. That doesn’t sound too bad and is unrelated to difficulty with RSUs.

I linked you the wrong thing, sorry 🤦 I meant to link a reddit thread discussing employee RSU rates at Nvidia, but now I can’t find it because Google AI has decided that I don’t need to see that anymore.

I’m sure you can find it if you google (again sorry), but there was definitely a lot of mixed bag experiences on it, you’re right. The people who got in by 2015-2016 and got some seniority are making out like bandits now.